Selling and Buying a Home at the same time? Make sure you follow this guide!

The Ultimate Guide to Selling a Home While Buying Another

(Timing, Contingencies & Avoiding Two Mortgages)

Buying a new home while selling your current one sounds simple in theory—but in reality, it’s a juggling act that can get messy if you’re not prepared.

If you don’t time things right, you could end up:

🚩 Carrying two mortgages at the same time (ouch!).

🚩 Losing out on your dream home because your current one hasn’t sold.

🚩 Being forced to move twice if you can’t line up both transactions.

But don’t worry—this guide will walk you through every step, the biggest mistakes to avoid, and how to time everything right so you sell your current home and buy your next one smoothly.

1. The Three Main Strategies (Pick the One That Works for You!)

Before you do anything, you need a game plan. Here are your three main options:

Option 1: Sell First, Then Buy (Lower Risk, But You May Need Temporary Housing)

- Sell your current home first, then use the proceeds to buy your next home.

- Avoids the risk of carrying two mortgages at once.

- BUT: You may need to find temporary housing (like renting short-term or staying with family).

Best For: Sellers in hot markets who know their home will sell quickly and want maximum negotiating power when buying.

Option 2: Buy First, Then Sell (Higher Risk, But You Stay in Control)

- Buy your new home first, then list your current home for sale.

- Allows you to move at your own pace without needing temporary housing.

- BUT: You might end up carrying two mortgages at once if your first home doesn’t sell fast enough.

Best For: Homeowners with strong finances or those who are confident their current home will sell quickly.

🚩 WARNING: Some lenders won’t approve you for a second mortgage unless you have the income to qualify for both loans at the same time.

Option 3: Buy & Sell at the Same Time (Ideal But Tricky—Timing Must Be Perfect!)

- List your home while you’re shopping for your next one.

- Aim to close both transactions on the same day (or close your sale first, then buy within a few days).

- BUT: Requires careful coordination to avoid delays.

Best For: Buyers in balanced markets where homes are selling steadily, but not overnight.

🚩 Common Myth: “I can just close both deals on the same day, no problem.”

✔ Reality: Delays in financing, inspections, or paperwork can easily push one deal back by days or even weeks.

2. How to Avoid Carrying Two Mortgages (Use These Strategies!)

The #1 concern most people have is how to avoid paying two mortgages at once. Here’s how you do it:

1. Use a Home Sale Contingency

- This lets you make an offer on a new home but ONLY move forward if your current home sells.

- Pro: Protects you from getting stuck with two mortgages.

- Con: In a competitive market, sellers might not accept your offer if they have buyers who don’t have a contingency.

PRO TIP: If your market is hot, try offering above asking price or flexible terms to make your contingent offer stronger.

2. Get a Bridge Loan (Short-Term Financing to Fill the Gap)

- A short-term loan that covers your down payment on the new home before you sell your current one.

- Pro: Lets you buy before you sell, so you don’t have to rush your move.

- Con: Higher interest rates and short repayment periods (usually 6-12 months).

PRO TIP: If you expect your home to sell quickly, a bridge loan can give you breathing room without committing to two long-term mortgages.

3. Negotiate a Rent-Back Agreement (Stay in Your Home After Closing!)

- Sell your home but negotiate to rent it back from the buyer for 30-60 days.

- Pro: Gives you time to buy and move into your next home without needing temporary housing.

- Con: Not all buyers will agree, especially if they’re in a rush to move in.

PRO TIP: Offer to cover the buyer’s mortgage payments during the rent-back period to make this deal more attractive.

3. Timing Both Transactions for a Smooth Move (What to Expect & What Can Go Wrong!)

Even with the best plan, real estate transactions are unpredictable. Here’s how to keep things on track:

1. Start by Selling (If Possible!)

- Get your home on the market ASAP while you’re shopping for your next one.

- If you get an offer, negotiate a closing date that aligns with your purchase timeline.

🚩 Common Mistake: Waiting too long to list your home, then scrambling when you find the perfect house.

✔ Solution: Get your home ready to sell before you start house hunting.

2. Line Up Financing Early (Even If You Plan to Use Sale Proceeds!)

- Get pre-approved for your new mortgage before listing your current home.

- Ask your lender about bridge loans or home equity options just in case there’s a delay.

🚩 Common Mistake: Waiting until your home sells before applying for a new mortgage.

✔ Solution: Have financing in place before listing your home so you can act fast.

3. Be Ready for Unexpected Delays

Even with perfect planning, things can still go sideways. Some common issues:

❌ Buyer’s financing falls through last minute.

❌ Unexpected inspection issues delay closing.

❌ Your new home’s seller has delays on their end.

How to Prepare:

- Have a backup plan (short-term rental, extended closing date).

- Don’t cut it too close—leave room for unexpected delays!

PRO TIP: Schedule your moving truck AFTER both closings are confirmed. Too many buyers get stuck paying extra fees when there’s a last-minute delay.

4. Final Checklist: How to Sell & Buy Without Stress

BEFORE You List Your Home:

✔ Get pre-approved for your next mortgage.

✔ Talk to an agent about pricing & market conditions.

✔ Declutter & make minor updates to attract buyers.

WHILE Your Home is on the Market:

✔ Start house hunting, but don’t rush into an offer.

✔ Consider rent-back or contingency options if needed.

✔ Stay flexible on closing dates to align both transactions.

ONCE YOU ACCEPT AN OFFER:

✔ Negotiate closing dates that match your new home’s timeline.

✔ Have backup financing in place (just in case).

✔ Plan for moving costs & temporary housing if needed.

🚨 AVOID THESE MISTAKES:

❌ Listing your home too late and missing out on your dream home.

❌ Not having a backup plan in case of delays.

❌ Assuming both closings will happen on the same day without issues.

Final Thoughts: The Smartest Way to Buy & Sell at the Same Time

If you want to buy a home while selling your current one, it’s all about timing, strategy, and having a solid plan.

DO THIS:

✔ Get pre-approved before listing your home.

✔ Use contingencies, bridge loans, or rent-backs to avoid two mortgages.

✔ Work with an agent who can coordinate both transactions smoothly.

AVOID THIS:

❌ Don’t assume everything will close on the same day.

❌ Don’t forget about backup financing options.

❌ Don’t rush—get your home market-ready first!

Need Help Buying & Selling at the Same Time?

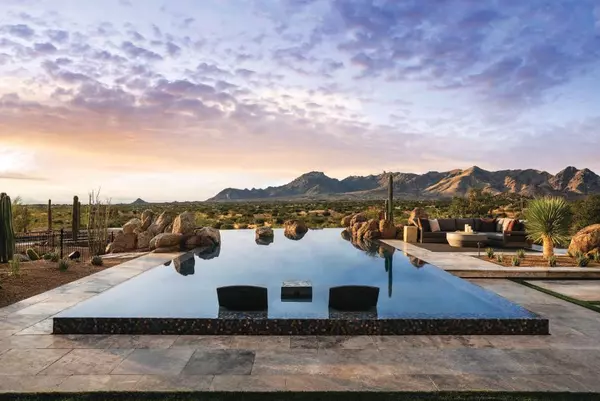

If you’re thinking about selling your home while buying another in Gilbert, Chandler, Queen Creek, or Mesa, let’s chat! I can help you line up everything so it goes as smoothly as possible.

Recent Posts